B2B Bank

Chequing Account

Available to existing B2B Bank clients only.*

Saves money

- No monthly account fee1

- No minimum balance required

Rewarding

Earn interest on your daily account balance

Convenient

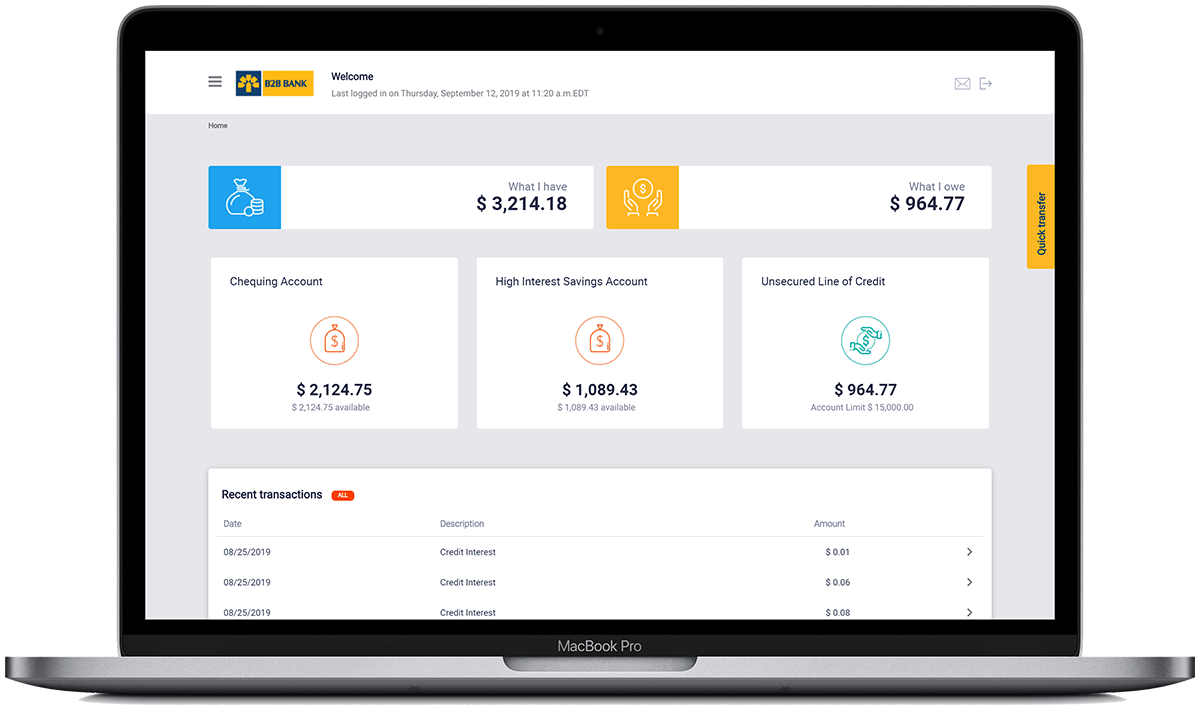

An easy to manage online banking experience

Effective March 14, 2020, the B2B Bank Chequing Account interest rate for all tiers changed to 0.00%.

Interest rates

Current interest rates2 — as of March 14, 2020

| ACCOUNT BALANCE | INTEREST RATE |

|---|---|

| $0 - $49,999.99 | 0.00% |

| $50,000.00 - $99,999.99 | 0.00% |

| $100,000.00+ | 0.00% |

2 B2B Bank Chequing Account rates as of March 14, 2020. All rates are subject to change at any time without prior notice. The applicable tier rate is paid on every dollar in the account. Interest rates are per annum. Interest is calculated daily on the closing balance and paid monthly on the last day of the month into the account.

B2B Bank Chequing Account features

Account features

- Deposits and withdrawals

- Bill payments

- Transfer money

INTERAC®†

e-Transfer

Free to send and receive money using INTERAC e‑Transfer.

THE EXCHANGE®† Network

Access to over 3,500

surcharge-free ATMs in every province and territory

in Canada.

Bank with us

For your daily banking needs, we offer simple banking solutions that provide you with convenient online access to your accounts.

Chequing interest rates

Current interest rates1 - as of March 14, 2020

1 Rates as of March 14, 2020. All rates are subject to change at any time without prior notice. The applicable tier rate is paid on every dollar in the account. Interest rates are per annum. Interest is calculated daily on the closing balance and paid monthly on the last day of the month into the account.

| ACCOUNT BALANCE | INTEREST RATE | |||

| $0 - $49,999.99 | 0.00% | |||

| $50,000.00 - $99,999.99 | 0.00% | |||

| $100,000.00+ | 0.00% | |||

Fee schedule

Effective December 8, 2023

Download fee schedule

|

Daily banking fees |

|

|---|---|

| Monthly account fee | Free |

| Electronic fund transfers | Free |

| Transfers between B2B Bank accounts | Free |

| Cheque clearing | Free |

| Pre-authorized deposits/debits | Free |

| Bill payments | Free |

|

ATM access fees2 |

|

| THE EXCHANGE®† Network ATMs | Free |

| Accel®† debit payments network ATMs (U.S. only) | Free2,3 |

| INTERAC®† Network ATMs | $1.502 |

| PLUS* Network ATMs (outside Canada) | $4.00 plus a 2.5% foreign currency conversion fee2,4 |

|

Other fees |

|

| Cheque supplies | Third party supplier fees apply. Fees vary by quantity and style. |

| Stop payment with complete details | $12.50 |

| Stop payment with partial details | $20.00 |

| Bank draft | $10.00 |

| Early closure fee (within 90 days of opening) | $25.00 |

| Non-sufficient funds (NSF) | $50.00 |

| Returned items | $5.00 |

| Overdrawn interest rate | 21% per annum5 |

|

Dormant annual account fees6 |

|

| 2 years to 9 years | $25.00 per year |

| 10 years | $40.00 |

|

Record keeping |

|

| Monthly online statement | Free |

| Monthly paper statement | Free |

Questions?

How can I deposit money into my chequing account?

You can deposit money into your chequing account by linking the account with your other financial institution, through an internal account transfer or by depositing cash or a cheque at an EXCHANGE® Network ATM.

Where can I access THE EXCHANGE®† Network ATMs?

Visit b2bbank.com/find-an-atm to find an ATM near you.

What makes us different?

You’re independent. Your finances should be too.

At B2B Bank, we believe that all Canadians should have access to a financial professional because the right advice, a sound financial plan and the right solutions are vital to financial health.

*The B2B Bank High Interest Savings Account (HISA), B2B Bank Chequing Account and non-registered B2B Bank GICs (purchased via onlinebanking.b2bbank.com) are only available to existing B2B Bank clients. Restrictions may apply.

1 B2B Bank Chequing Account rates as of March 14, 2020. All rates are subject to change at any time without prior notice. The applicable tier rate is paid on every dollar in the account. Interest rates are per annum. Interest is calculated daily on the closing balance and paid monthly on the last day of the month into the account.

2 Certain ATM operators, financial institutions and merchants may charge a convenience fee or a surcharge fee when using the INTERAC, PLUS, Accel or any other network other than THE EXCHANGE Network. These fees are not B2B Bank fees.

3 Foreign currency transactions made by debit card and any fees charged by the ATM provider are converted to Canadian dollars at the exchange rate set by FICANEX Services Limited Partnership and Fiserv EFT in effect on the date the transaction is processed. Any fee charged by the ATM or network operator after conversion to Canadian dollars will then be added. Since exchange rates fluctuate, the exchange rate applied to your account will usually differ from the exchange rate at the time of the transaction.

4Foreign currency transactions made by debit card and any fees charged by the ATM provider are converted to Canadian dollars at an exchange rate set by Visa International in effect on the date the transaction is processed. A fee of 2.5% of the transaction amount after conversion will be added, plus any fee charged by the ATM or network operator after conversion to Canadian dollars. Since exchange rates fluctuate, the exchange rate applied to your account will usually differ from the exchange rate at the time of the transaction.

5Interest is calculated daily on the closing overdrawn balance and charged monthly. Each month you will deposit an amount that will cover the monthly overdrawn interest.

6 Inactive account notices will be sent at two, five and nine years of inactivity. If inactive notice is acknowledged within 60 days, there is no charge. If the balance of the dormant account is less than the fee to be collected, the charges correspond to the remaining balance.